-

Financial statement auditing

A Company’s financial statements constitute an important management tool that contributes to the ability to analyze and evaluate the organization's performance, both in the operational field and in the financial field.

-

Financial statement preparation

The independence principle has to be upheld. Companies have to get used to the fact that regulatory requirements prohibit their auditors from assisting them in preparing their financial statements.

-

Additional services as part of the audit process

Assistance and consulting on solving accounting problems

-

Internal audit

Fahn Kanne Control Management Ltd. Grant Thornton Israel renders internal auditing and control services to a broad range of entities. During the course of an internal audit, we utilize the services of experts from other departments, based on the nature and the needs of the audit: Information systems audit department, forensic accounting department, payroll control department, financial control department, etc. Contact us: info@il.gt.com

-

Sarbanes Oxley Implementation

Fahn Kanne Control Management will assist you in preparing the company for the requirements of article 404 of the Sarbanes Oxley Act (SOX). Our firm has extensive experience in implementing SOX at dozens of companies, using the methodology of Grant Thornton International.

-

Auditing the quality of the internal audit (QAR)

Yossi Ginossar, CEO of Fahn Kanne Control Management Ltd. Grant Thornton Israel possesses the required certification to conduct assessments of the quality control of internal audit framework (QAR). A number of entities in Israel have adopted standards 1300 and 1321 of the International Association of Internal Auditors (IIA) that stipulates that firms must have a third-party consultant perform an assessment of the quality control of their internal audit framework (QAR). Contact Yossi: yossi.ginossar@il.gt.com

-

Risk Management

Our team has extensive experience in evaluation and management of risks and controls. We are assisted by one of the world's most advanced international methodologies, in order to properly evaluate the business processes.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Fraud and embezzlement prevention

What is a multi-year plan for the prevention of embezzlements? It is much more economical to take appropriate measures to prevent embezzlements from being perpetrated. The multi-year plan serves as a tool that assists the organization in contending with frauds and embezzlements risk. Shay Medina, CPA, Partner at Fahn Kanne Control Management Ltd. Grant Thornton Israel and Head of Investigative Accounting Department specializes in conducting these plans. Contact Shay: Shay.Medina@il.gt.com

-

Information systems auditing

The threats against the organizational information systems are many and varied. therefore, protecting and securing them is of paramount importance. Fahn Kanne Control Management Grant Thornton Israel has the know-how and experience in the fields of auditing together with information systems and therefore provides Information systems auditing.

-

Service Organization Control Report (SOC 1 2 3)

Fahn Kanne Control Management Ltd. Grant Thornton Israel possess the know-how that is needed to provide examination of the fairness of controls - we render SOC services, including: A SOC-1 report based in standards ISAE 3402 / SSAE 16 (formerly SAS 70) and Checking the preparations and preparedness for compliance with the requirements of the standard. Contact us: yisrael.gewirtz@il.gt.com

-

BlockChain & Cryptocurrency

Blockchain, the technology behind digital currency in Bitcoin, has been unleashed. Given the interest in blockchain beyond financial services in the service, transportation, business and government sectors - it is gaining momentum.

-

Privacy Protection GDPR

Privacy Protection GDPR

-

Payroll control

The control reports that we at Fahn Kanne Control Management Ltd. Grant Thornton Israel design for our clients include deviance reports: checking the payment of the same salary component twice, payment of salary components that contradict one another, payment of salaries to fictitious employees, granting salary raises at unreasonable intervals, payment of a salary component in an amount that is unreasonable, etc. Contact us: Roei.Simhy@il.gt.com

-

Business consulting

Many companies face significant business decisions which may have an impact on their future.

-

Dispute advisory

Dispute advisory

-

Due Diligence

Fahn Kanne's advisory team provides robust due diligence services that are linked to our clients’ requirements.

-

Innovation and Incentives support

The Incentives department offers a full range of consulting services. From fund raising and management of local and international R&D funds, submission to international tenders and more.

-

Valuations

Are you involved in a transaction, dispute or re-structuring your business? The value of your business and its assets will be a critical commercial consideration. Is litigation a possibility? A professional valuation is often the key to securing a fair settlement. Expert opinions are an inherent part of our offering.

-

International services

International services

-

Data analytics

With the ever-increasing reliance on information technologies at many organizations, the risk levels related to these technologies and to the processes supported by them continue to grow. The dedicated information systems consultancy department at Fahn Kanne Grant Thornton Israel, specializes in various IT issues: IT Advisory, Data analysis, Service bureaus. Contact us: amiel.attias@il.gt.com

-

Liquidations receiverships and special management

Liquidations receiverships and special management

-

People advisory

People advisory

-

Recovery and reorganization

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

-

Strategy

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

-

Transactional advisory services

Our dedicated business consulting team consists of experienced professions with expertise in the area of mergers & acquisitions.

-

Financial sevices

We, at Fahn Kanne Consulting Ltd. Grant Thornton Israel provide a unique and strategic viewpoint on current banking issues. Our srvices include: Accompanying debt arrangements with banks, Valuations for banks and credit portfolios, Validation of models of structured products for banks and more. Visit our website to learn more about our services.

-

Litigation support

Litigation support

-

Corporate finance

Many companies face significant business decisions which may have an impact on their future.

-

Debt advisory

All-time low interest rates across Europe and the USA have resulted in investors looking to find new ways to generate a return on their cash.

-

Financial modelling

Models are at the heart of all business decisions. Whether you're looking to raise finance, buy or sell a business, assess strategic options, or just plan for the future, you're going to need a forecast. This is likely to come from a financial model.

-

Operational deal services

The due diligence checks the accounting records, liabilities to employees, non-bank guarantees, the existence of hidden commitments, and the existence of surplus assets that the prior owners are attempting to remove from the company. Examining these parameters helps to reduce the risk to the investor in acquiring a company. Contact us: Mickey.Blumenthal@il.gt.com

-

Restructuring

The due diligence checks the accounting records, liabilities to employees, non-bank guarantees, the existence of hidden commitments, and the existence of surplus assets that the prior owners are attempting to remove from the company. Examining these parameters helps to reduce the risk to the investor in acquiring a company. Contact us: Mickey.Blumenthal@il.gt.com

-

Transaction services

Fahn Kanne's professional staff will assist you through all phases of the transaction to achieve the most optimal results, and to execute transactions for the long-term.

-

Valuations

Fahn Kanne's valuation team has extensive knowledge, international reach and technical expertise to help organizations measure value and make better, more informed decisions.

-

International taxation

The world is a global village, with companies operating concurrently in different countries and contending with wide range of international tax issues. You need to advise with international tax experts! The International tax department of Fahn Kanne Grant Thornton Israel provides Professional services: Planning tax structures, accompaniment of investment transactions and activities, foreign VAT, transfer pricing, relocation issues, etc. Contact us: Shay.Moyal@il.gt.com

-

International taxation

The world is a global village, with companies operating concurrently in different countries and contending with wide range of international tax issues. You need to advise with international tax experts! The International tax department of Fahn Kanne Grant Thornton Israel provides Professional services: Planning tax structures, accompaniment of investment transactions and activities, foreign VAT, transfer pricing, relocation issues, etc. Contact us: Shay.Moyal@il.gt.com

-

Transfer pricing

The transfer pricing department at Fahn Kanne recognizes the need to meet the regulatory requirements concerning transfer pricing, while preserving efficiency versus cost and reducing possible tax exposure. Our firm provides an overall solution that is tailored to the needs of the client, the goals of the organization and the nature of the transaction.

-

Trust Taxation

Trust Taxation

-

Indirect international tax

Fahn Kanne's Tax Department has expertise in the field of indirect taxation, including accompaniment, handling and consulting on a range of issues in the field of indirect taxation, including Value Added Tax, excise tax and customs. These issues may have a significant impact on the results of operations of many companies.

-

U.S. taxation

The members of Fahn Kanne’s U.S. taxation team provide services regarding compliance and consulting on a large number of complex transactions at the local, national and international levels. Our client base includes large corporations, international businesses, family businesses, local businessmen and others. We provide tailored assistance with a high level of partner involvement.

-

Capital investment incentives

Encouraging capital investment

-

Individual taxation

Individual taxation

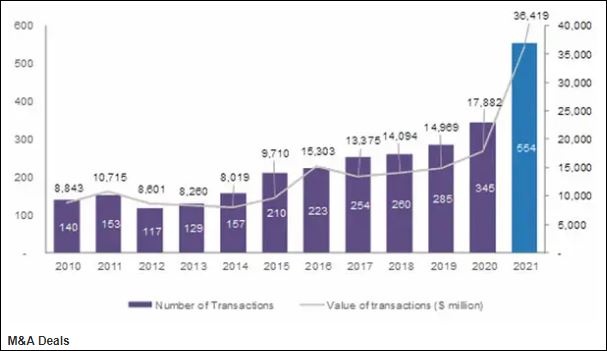

A new record was set last year for corporate deals

According to the annual report by the accounting firm Fahn Kanne Grant Thornton Israel, a new record was set last year for corporate deals: there were 554, representing an annual growth rate of 100%, including a 74% surge in M&As

Yoel Zafrir, Partnered with Fahn Kanne Grant Thornton

The annual deals report published by the Fahn Kanne Grant Thornton accounting firm reveals that in 2021 the Israeli deals market broke new records. Just as in developed countries in Europe, where there was substantial growth in the scope of deals, Israel also displayed considerable growth in both the number and scope of deals transacted in 2021.

This growth trend in Israeli deals parallels increases in the U.S. and select European countries, reflecting the continued globalization of the world of corporate deals.

Last year, the overall value of deals in Israel’s private sector (mergers and acquisitions and investment deals) continued to show growth, reaching $36 billion. This number represents a 100% increase in the financial value of executed deals compared to 2020. In terms of the quantity of deals, in 2021 there were 554, which is 61% more than in the previous year.

There was also a substantial jump (59%) in the number of investment deals. Investments continue to be the main engine driving the Israeli deal market, with a total of 495 investment deals reported in 2021. Mergers and acquisitions (M&As), which were badly affected by the Covid-19 crisis and shrunk by 40% in 2020, recovered in 2021, growing by 74%.

Change in exit strategy

The technology industry ended the year with 455 deals valued at $29 billion. The number of large deals ($50M-1B) grew by 120% compared with 2020, totaling 188 deals.

According to Shlomi Bartov, CPA, who is a Partner at Fahn Kanne & Co and the CEO of Fahn Kanne Consulting Ltd., the firm that prepared the report, this figure stems from a growing trend among companies to change their exit strategy. Instead of companies chasing a “fast exit,” they invest in building value over the long term, and the exit only takes place once the company reaches maturity.

This approach results in a larger number of deals and higher price tags. Given the fact that the companies’ increased value takes place over a long period of time through investment deals, these companies are expected to continue being involved in fundraising and exits in the next few years. Furthermore, there were seven mega-deals last year (over $1B) – three more than in 2020.

In 2021, there were 93 IPOs at the Tel Aviv Stock Exchange – an escalation of the trend that began in November-December 2020 (during which there were 13 IPOs). High price levels in Israel and around the world, as demonstrated by high multipliers and the possibility of merging with SPACs, affected the status of stock exchanges as an additional option or alternative to investment and M&A deals.

Out of approximately 250 industries analyzed in 2021 and compared with 2019, the “hottest” industries which stood out thanks to the large scope of investments (without M&A deals) are all in the high-tech sector. The leading fields in the deals market showing unusually high investment growth rates are: application software (225%), data security (234%), and software including cyber (281%).

American and Israeli investors continue to dominate

Segmenting investors in Israeli target companies according to nationality reveals that American and Israeli investors continue to be the most dominant in deals where Israeli companies were purchased – with 219 and 206 deals respectively. Among European investors in 2021, the lion’s share came from the U.K., Germany, France and Switzerland.

Investors from Asia mainly were from Singapore, China, Japan, South Korea and Hong Kong.

Mickey Blumenthal, CPA, Managing Partner at Fahn Kanne Grant Thornton, added that, “just like in developed countries where there was a substantial growth in the scope of deals, Israel showed considerable growth in 2021 both in the quantity and the value of deals that were carried out.

The growth trend in the Israeli deals market in 2021 is in line with the growth rates in the U.S. and select European countries, and reflects the continued globalization of the world of deals.”