-

Financial statement auditing

A Company’s financial statements constitute an important management tool that contributes to the ability to analyze and evaluate the organization's performance, both in the operational field and in the financial field.

-

Financial statement preparation

The independence principle has to be upheld. Companies have to get used to the fact that regulatory requirements prohibit their auditors from assisting them in preparing their financial statements.

-

Additional services as part of the audit process

Assistance and consulting on solving accounting problems

-

Internal audit

Fahn Kanne Control Management Ltd. Grant Thornton Israel renders internal auditing and control services to a broad range of entities. During the course of an internal audit, we utilize the services of experts from other departments, based on the nature and the needs of the audit: Information systems audit department, forensic accounting department, payroll control department, financial control department, etc. Contact us: info@il.gt.com

-

Sarbanes Oxley Implementation

Fahn Kanne Control Management will assist you in preparing the company for the requirements of article 404 of the Sarbanes Oxley Act (SOX). Our firm has extensive experience in implementing SOX at dozens of companies, using the methodology of Grant Thornton International.

-

Auditing the quality of the internal audit (QAR)

Yossi Ginossar, CEO of Fahn Kanne Control Management Ltd. Grant Thornton Israel possesses the required certification to conduct assessments of the quality control of internal audit framework (QAR). A number of entities in Israel have adopted standards 1300 and 1321 of the International Association of Internal Auditors (IIA) that stipulates that firms must have a third-party consultant perform an assessment of the quality control of their internal audit framework (QAR). Contact Yossi: yossi.ginossar@il.gt.com

-

Risk Management

Our team has extensive experience in evaluation and management of risks and controls. We are assisted by one of the world's most advanced international methodologies, in order to properly evaluate the business processes.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Fraud and embezzlement prevention

What is a multi-year plan for the prevention of embezzlements? It is much more economical to take appropriate measures to prevent embezzlements from being perpetrated. The multi-year plan serves as a tool that assists the organization in contending with frauds and embezzlements risk. Shay Medina, CPA, Partner at Fahn Kanne Control Management Ltd. Grant Thornton Israel and Head of Investigative Accounting Department specializes in conducting these plans. Contact Shay: Shay.Medina@il.gt.com

-

Information systems auditing

The threats against the organizational information systems are many and varied. therefore, protecting and securing them is of paramount importance. Fahn Kanne Control Management Grant Thornton Israel has the know-how and experience in the fields of auditing together with information systems and therefore provides Information systems auditing.

-

Service Organization Control Report (SOC 1 2 3)

Fahn Kanne Control Management Ltd. Grant Thornton Israel possess the know-how that is needed to provide examination of the fairness of controls - we render SOC services, including: A SOC-1 report based in standards ISAE 3402 / SSAE 16 (formerly SAS 70) and Checking the preparations and preparedness for compliance with the requirements of the standard. Contact us: yisrael.gewirtz@il.gt.com

-

Blockchain & cryptocurrency

Blockchain, the technology behind digital currency in Bitcoin, has been unleashed. Given the interest in blockchain beyond financial services in the service, transportation, business and government sectors - it is gaining momentum.

-

Privacy Protection GDPR

Privacy Protection GDPR

-

Payroll control

The control reports that we at Fahn Kanne Control Management Ltd. Grant Thornton Israel design for our clients include deviance reports: checking the payment of the same salary component twice, payment of salary components that contradict one another, payment of salaries to fictitious employees, granting salary raises at unreasonable intervals, payment of a salary component in an amount that is unreasonable, etc. Contact us: Roei.Simhy@il.gt.com

-

Occupational Safety and Health

The department specializes in the following matters: Safety consulting and auditing for leading companies. Investigation and assessment of safety incidents. Consultation on formulating an internal enforcement plan in the field of safety in the organization.

-

Business consulting

Many companies face significant business decisions which may have an impact on their future.

-

Dispute advisory

Dispute advisory

-

Due Diligence

Fahn Kanne's advisory team provides robust due diligence services that are linked to our clients’ requirements.

-

Innovation and Incentives support

The Incentives department offers a full range of consulting services. From fund raising and management of local and international R&D funds, submission to international tenders and more.

-

Valuations

Are you involved in a transaction, dispute or re-structuring your business? The value of your business and its assets will be a critical commercial consideration. Is litigation a possibility? A professional valuation is often the key to securing a fair settlement. Expert opinions are an inherent part of our offering.

-

International services

International services

-

Data analytics

With the ever-increasing reliance on information technologies at many organizations, the risk levels related to these technologies and to the processes supported by them continue to grow. The dedicated information systems consultancy department at Fahn Kanne Grant Thornton Israel, specializes in various IT issues: IT Advisory, Data analysis, Service bureaus. Contact us: amiel.attias@il.gt.com

-

Liquidations receiverships and special management

Liquidations receiverships and special management

-

People advisory

People advisory

-

Recovery and reorganization

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

-

Strategy

We provide a wide range of services to recovery and reorganisation professionals, companies and their stakeholders.

-

Transactional advisory services

Our dedicated business consulting team consists of experienced professions with expertise in the area of mergers & acquisitions.

-

Financial sevices

We, at Fahn Kanne Consulting Ltd. Grant Thornton Israel provide a unique and strategic viewpoint on current banking issues. Our srvices include: Accompanying debt arrangements with banks, Valuations for banks and credit portfolios, Validation of models of structured products for banks and more. Visit our website to learn more about our services.

-

Corporate finance

Many companies face significant business decisions which may have an impact on their future.

-

Debt advisory

All-time low interest rates across Europe and the USA have resulted in investors looking to find new ways to generate a return on their cash.

-

Financial modelling

Models are at the heart of all business decisions. Whether you're looking to raise finance, buy or sell a business, assess strategic options, or just plan for the future, you're going to need a forecast. This is likely to come from a financial model.

-

Operational deal services

The due diligence checks the accounting records, liabilities to employees, non-bank guarantees, the existence of hidden commitments, and the existence of surplus assets that the prior owners are attempting to remove from the company. Examining these parameters helps to reduce the risk to the investor in acquiring a company. Contact us: Mickey.Blumenthal@il.gt.com

-

Restructuring

The due diligence checks the accounting records, liabilities to employees, non-bank guarantees, the existence of hidden commitments, and the existence of surplus assets that the prior owners are attempting to remove from the company. Examining these parameters helps to reduce the risk to the investor in acquiring a company. Contact us: Mickey.Blumenthal@il.gt.com

-

Transaction services

Fahn Kanne's professional staff will assist you through all phases of the transaction to achieve the most optimal results, and to execute transactions for the long-term.

-

Valuations

Fahn Kanne's valuation team has extensive knowledge, international reach and technical expertise to help organizations measure value and make better, more informed decisions.

-

International taxation

The world is a global village, with companies operating concurrently in different countries and contending with wide range of international tax issues. You need to advise with international tax experts! The International tax department of Fahn Kanne Grant Thornton Israel provides Professional services: Planning tax structures, accompaniment of investment transactions and activities, foreign VAT, transfer pricing, relocation issues, etc. Contact us: Shay.Moyal@il.gt.com

-

Indirect international tax

Fahn Kanne's Tax Department has expertise in the field of indirect taxation, including accompaniment, handling and consulting on a range of issues in the field of indirect taxation, including Value Added Tax, excise tax and customs. These issues may have a significant impact on the results of operations of many companies.

-

Transfer pricing

The transfer pricing department at Fahn Kanne recognizes the need to meet the regulatory requirements concerning transfer pricing, while preserving efficiency versus cost and reducing possible tax exposure. Our firm provides an overall solution that is tailored to the needs of the client, the goals of the organization and the nature of the transaction.

-

U.S. taxation

The members of Fahn Kanne’s U.S. taxation team provide services regarding compliance and consulting on a large number of complex transactions at the local, national and international levels. Our client base includes large corporations, international businesses, family businesses, local businessmen and others. We provide tailored assistance with a high level of partner involvement.

-

Tax Aspects of Virtual Currency Activity in Israel

Virtual currencies (cryptographic) are gaining increasing interest among many entities in the global economy, for investment and trading purposes. In addition, in recent years, many start-ups have been established in Israel in the field of blockchain, the technology on which the field of virtual currencies is based, in order to offer advanced technological solutions to various issues.

-

Trust Taxation

Trust Taxation

-

Capital investment incentives

Encouraging capital investment

-

Individual taxation

Individual taxation

Drawing on our extensive financial reporting expertiseples

Annual Transactions Report of Grant Thornton Israel

Executive Summary-Recap of 2021

Growth in the transaction market – Following the stability of the transaction’s market during COVID-19 pandemic crisis in 2020, the Israeli’s transaction’s market keeps hitting new records.

Throughout 2021, the volume of the total transactions (M&A and investment transactions) kept growing, reaching to 36 billion dollars.

An increase of 100% in comparison to 2020. Transaction value – The median transaction value in 2020 was about $30 million, higher than in previous years. High rate of large-size transactions – The number of large transactions (between $50 to $1 billion dollars) executed in 2021 was 188, about 120% higher in comparison with 2020.

TASE activity – In the first 11 months of 2021 89 IPOs were issued, mostly tech companies. An upward trend starting from November & December of 2021 with a total of 13 IPOs that were issued.

In September 2021 the permanent FDA’s approval of Pfizer’s COVID-19 vaccination and the use of the third vaccination in Israel, had a positive effect on the trade activity in TASE.

International comparison– The number and amount of the total transactions in Israel was indicating a substantial growth in 2021. As well, a significant growth was shown in developed European countries.

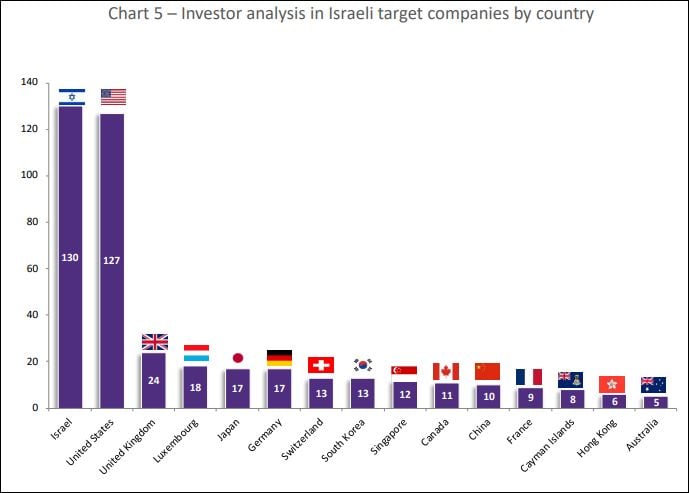

Foreign investors still believe in the Israeli technology – American investors are still the main buyers of Israeli companies’ acquisitions, they were involved in 219 transactions of Israeli companies. The main European investors of 2021, are from: UK, Germany, France and Switzerland. each one were involved in average of 30 transactions of Israeli companies.

The main Asian investors of 2021, are from: Singapore, China, Japan, South-Korea and Hong-Kong. each one were involved in average of 19 transactions of Israeli companies Industry analysis – The technology industry is the leading destination for investments in the Israeli market. About 78% of transactions are technologically oriented.

click here to continue reading [ 1678 kb ]